Closing a Bank Account: The Letter That Matters

The crisp rustle of paper, the weight of the pen in your hand – the act of writing a formal letter carries a certain significance. In today's digital world, the need for such formalities might seem anachronistic. Yet, when it comes to closing a bank account, a well-crafted letter remains essential. This seemingly simple act requires precision, ensuring a smooth transition and safeguarding your financial interests.

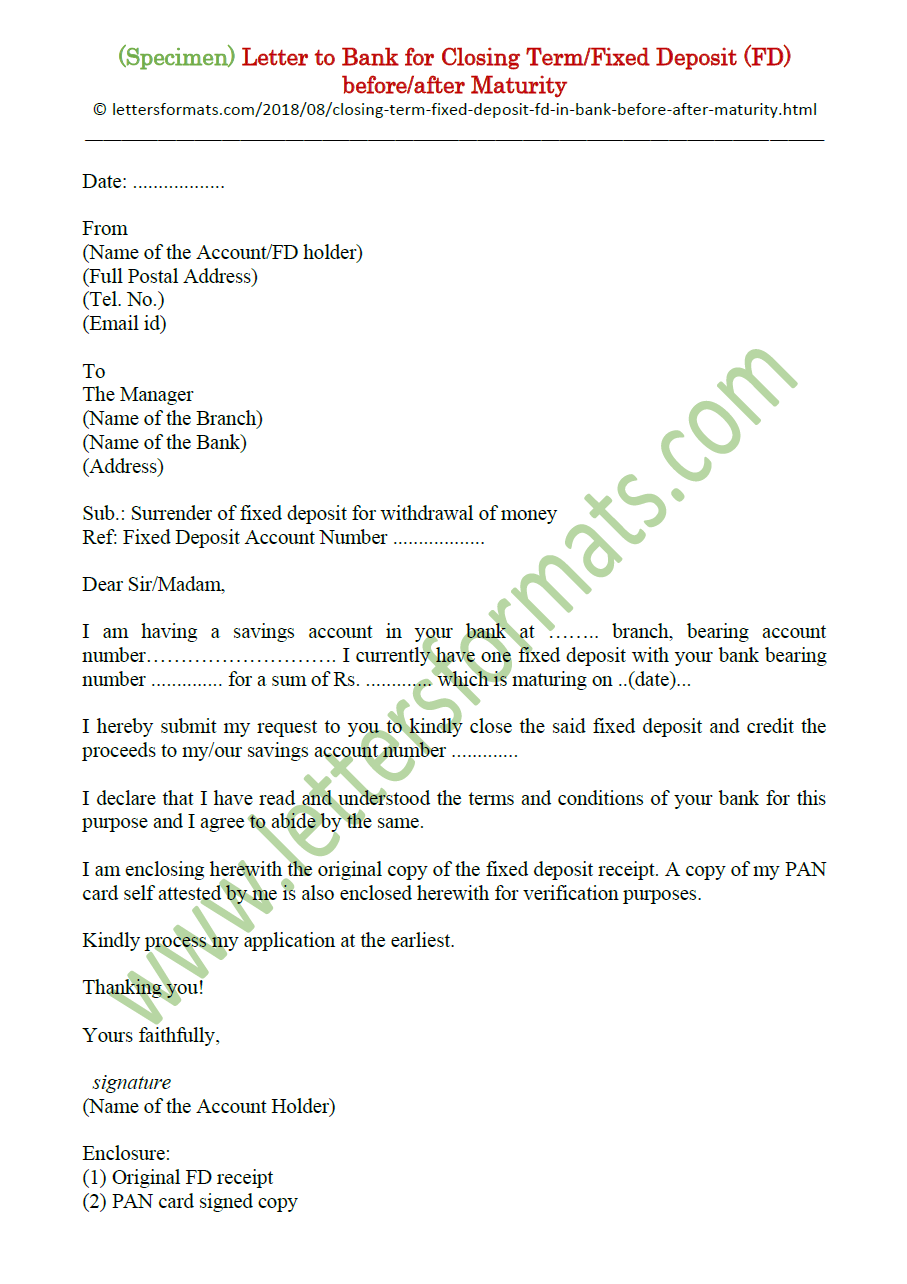

Navigating the process of closing a bank account involves more than just withdrawing your funds. A formal request, documented in writing, provides a clear record for both you and the bank. This record serves as evidence of your intention to sever ties and helps prevent future misunderstandings or complications. The "bank account closure letter format in Word" serves as a crucial tool in this process, offering a structured approach to ensure your request is handled effectively.

The tradition of formal letters for financial matters dates back centuries, reflecting a time when written documentation was paramount. While digital communication is prevalent today, the formal letter retains its significance, especially for important financial transactions. Closing a bank account, being a significant financial action, warrants the formality and clarity that a well-written letter provides.

The importance of a correctly formatted bank account closing letter cannot be overstated. It ensures that your request is understood, processed efficiently, and leaves no room for ambiguity. It eliminates the potential for errors or delays, protecting you from unnecessary fees or complications. Imagine the frustration of having your account remain open, accruing charges, simply due to a poorly worded or incomplete request.

A bank account closure letter typically includes crucial details such as your account number, account type, reason for closure, forwarding address for remaining balance, and a request for confirmation of closure. Using a clear and concise "bank account closure letter format in Word" provides a framework for incorporating all these elements, ensuring a complete and effective communication with your bank.

One key issue related to closing bank accounts is ensuring all automatic payments and direct deposits are redirected. Your closure letter should mention any such arrangements, providing instructions to the bank for their cancellation or transfer. Neglecting this aspect can lead to missed payments, returned checks, and potential financial penalties.

A simple example of a closing request could be: "I am writing to request the closure of my savings account, account number [your account number]. Please transfer the remaining balance to [your new account number] at [your new bank name]."

Benefits of using a formal letter include: 1. Clear Communication: A formal letter eliminates ambiguity, ensuring the bank understands your intentions. 2. Proof of Request: The letter serves as evidence of your request, protecting you from potential disputes. 3. Professionalism: A formal approach reflects diligence and responsibility in handling your financial affairs.

Action Plan: 1. Gather necessary information (account numbers, forwarding address). 2. Draft your letter using a template. 3. Review and proofread for accuracy. 4. Submit the letter to your bank. 5. Follow up to confirm closure.

Advantages and Disadvantages of Using a Word Document

| Advantages | Disadvantages |

|---|---|

| Easy Formatting | Requires Word Software |

| Widely Accessible | Potential Compatibility Issues |

| Template Availability | Risk of Accidental Changes |

Best Practices: 1. Use a professional tone. 2. Be clear and concise. 3. Include all relevant information. 4. Proofread carefully. 5. Keep a copy for your records.

Challenges and Solutions: 1. Forgotten Automatic Payments - Solution: Review your account statement for recurring transactions. 2. Outstanding Checks - Solution: Wait for checks to clear before closing the account.

FAQs: 1. How long does it take to close an account? Answer: Typically a few business days. 2. What if I have outstanding checks? Answer: Wait for them to clear before closing.

Tips and Tricks: Use a template for a quick and easy process. Double-check all details for accuracy.

In conclusion, closing a bank account is a significant financial action that demands a formal and structured approach. Utilizing a well-crafted "bank account closure letter format in Word" provides clarity, ensures a smooth transition, and safeguards your financial interests. By following best practices and understanding the potential challenges, you can navigate this process with confidence. Taking the time to draft a proper letter, even in today's fast-paced digital world, underscores the importance of maintaining meticulous financial records and protecting your financial well-being. Remember to keep a copy of your letter for your records and follow up with your bank to confirm the account closure. This proactive approach ensures a clean break and minimizes the potential for future complications, leaving you free to focus on other financial endeavors.

Finding affordable fuel trailers near you

Crafting winning job offers with ms word templates

Unraveling the mystery the invention of maltesers