Closing Your Axis Bank Current Account A Comprehensive Guide

Terminating a banking relationship can feel like a significant step, especially when it involves a current account, often used for core financial activities. This guide aims to demystify the process of closing a current account with Axis Bank, providing a comprehensive overview of the procedure, requirements, and potential implications.

Understanding the intricacies of closing a current account with Axis Bank, or any financial institution, is essential for a smooth transition. This involves not just submitting a formal request but also ensuring all linked services and transactions are handled appropriately. This detailed guide will equip you with the knowledge needed to navigate this process effectively.

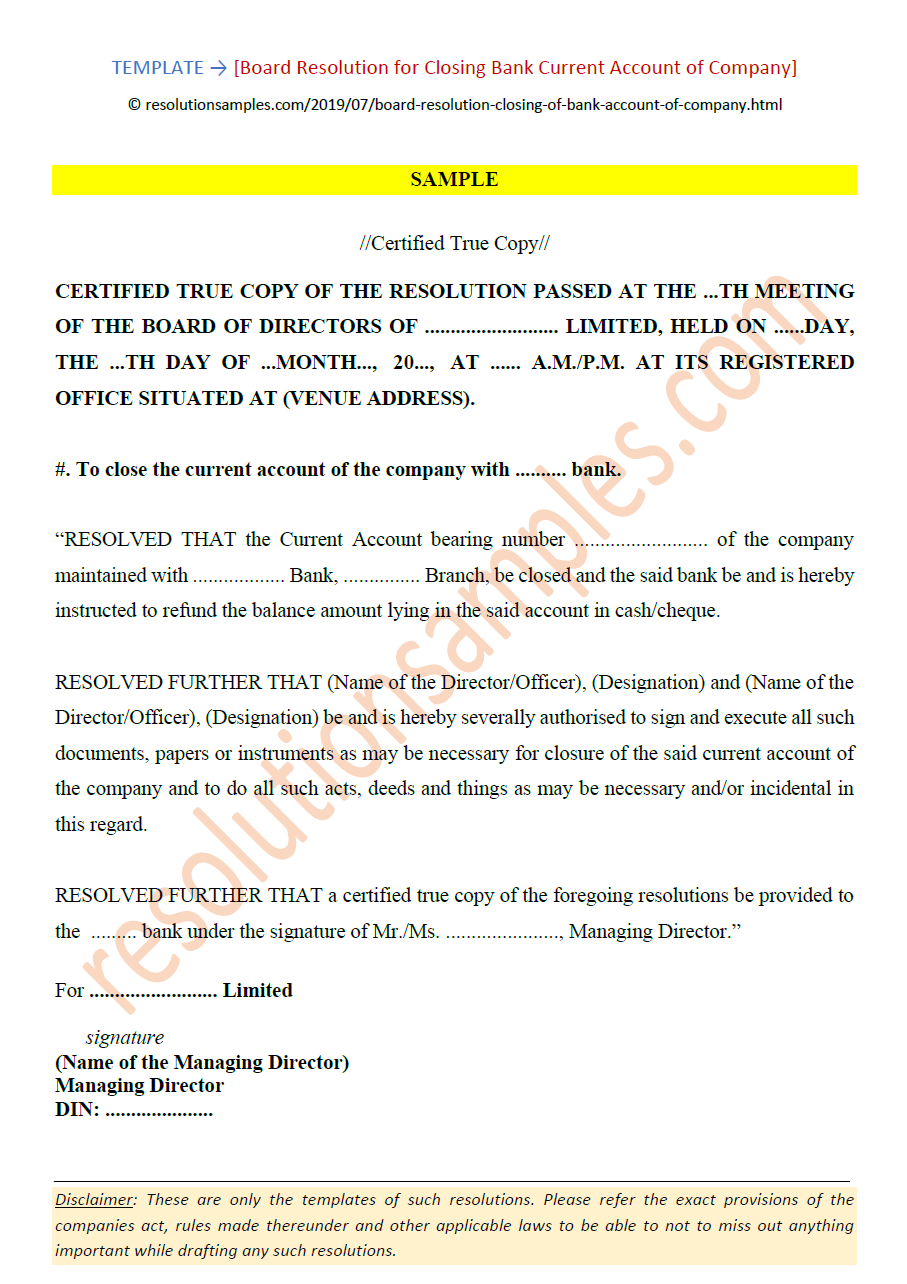

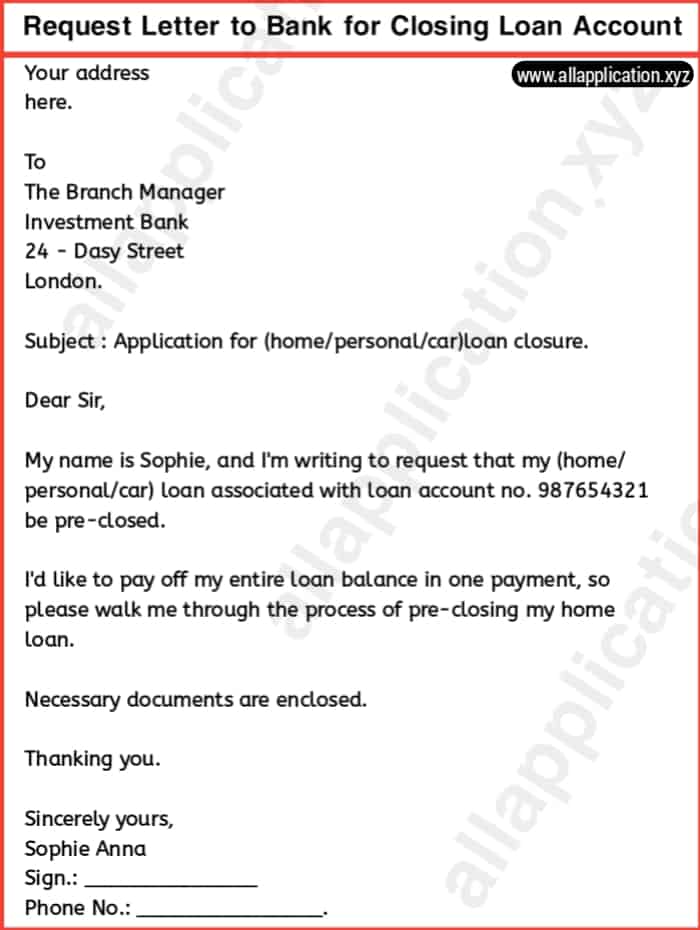

Requesting an Axis Bank current account closure requires a formal letter, a crucial document that initiates the termination process. This letter must include specific details to ensure clarity and avoid delays. We'll delve into the format and content of this letter, offering practical guidance and examples.

While the digital age has streamlined many banking operations, the account closure process often retains a traditional element: the physical closure letter. This document serves as a formal record of your request, initiating the bank's internal procedures for closing the account. This guide emphasizes the importance and components of the Axis Bank current account closure letter.

A well-crafted Axis Bank current account closure letter ensures a seamless transition and prevents potential complications. This document is more than just a formality; it's a vital step in protecting your financial interests. We will explore the key elements of this letter, providing practical tips for a clear and effective request.

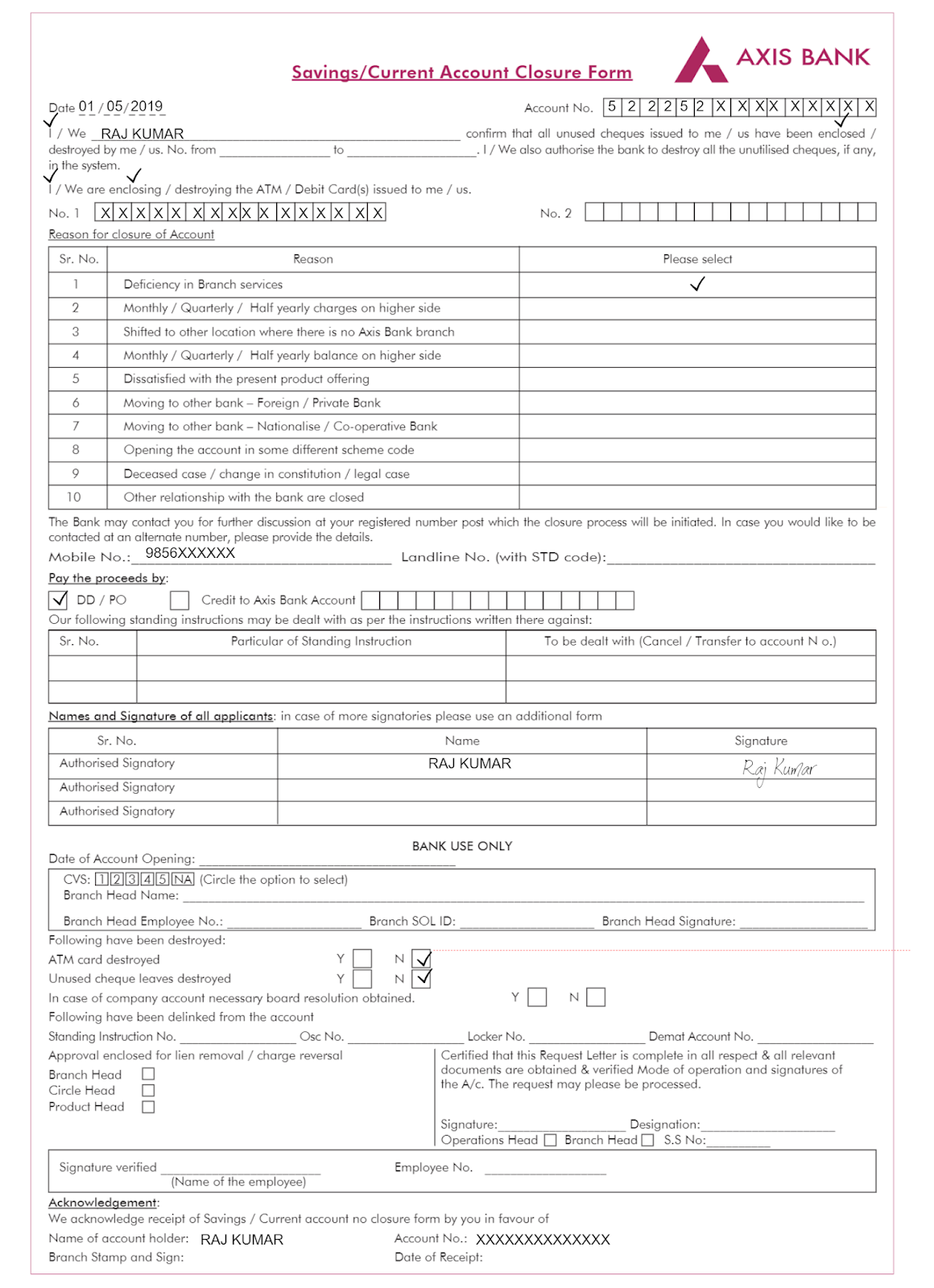

The process generally involves submitting a written request, settling outstanding dues, and transferring any remaining balance. There isn't a readily available public record detailing the specific historical origins of account closure procedures within Axis Bank. However, formal written requests have long been a standard practice in banking for maintaining auditable records of client instructions.

The Axis Bank current account closure letter is crucial because it officially initiates the termination of your account. Without it, the bank won't process your request. Common issues can include incorrect account details, missing signatures, or outstanding dues.

An Axis Bank current account closure letter is a formal written request submitted to the bank to terminate a current account held in your name. For example, if you're relocating permanently or switching to a different bank, you'd write this letter.

Benefits of closing an unwanted account include avoiding unnecessary fees, simplifying your finances, and reducing the risk of fraud.

Action Plan for Closing Your Axis Bank Current Account:

1. Gather necessary documents (account details, ID proof).

2. Draft the closure letter.

3. Visit your Axis Bank branch.

4. Submit the letter and complete required formalities.

5. Confirm the closure and obtain acknowledgement.Advantages and Disadvantages of Closing an Axis Bank Current Account

| Advantages | Disadvantages |

|---|---|

| Avoidance of maintenance fees | Loss of banking relationship |

| Simplified financial management | Potential inconvenience if linked services exist |

| Reduced risk of fraud on inactive accounts | Need to update payment information for recurring transactions |

Best Practices:

1. Maintain a copy of the closure letter for your records.

2. Verify the zero balance confirmation from the bank.

3. Update all automatic payments linked to the account.

4. Ensure all cheques issued have been cleared.

5. Destroy all debit cards associated with the closed account.

FAQs:

1. How long does it take to close an Axis Bank current account? Typically within 7-10 business days.

2. Can I close my account online? Contact your branch to determine online options.

3. What documents are required? Typically your ID proof and account details.

4. What happens to my remaining balance? It can be transferred to another account or provided as a cheque.

5. What if I have outstanding cheques? Ensure all cheques clear before initiating the closure process.

6. Can I reopen the account later? Contact your branch for options regarding account reactivation.

7. Will I receive confirmation of closure? Yes, usually a written acknowledgement.

8. Are there any charges for closing the account? Inquire with the bank about potential fees.

Tips and tricks: Always double-check your account details in the closure letter and ensure all linked services are updated before closing the account. Maintaining a copy of the closure letter and related documentation is highly recommended.

In conclusion, closing an Axis Bank current account involves a straightforward procedure primarily driven by the submission of a formal closure letter. Understanding the components of this letter, following the necessary steps, and adhering to best practices ensures a smooth and hassle-free experience. While there might be specific nuances based on individual circumstances, the core principles remain consistent. Taking proactive steps, such as verifying zero balance confirmation and updating linked services, safeguards your financial interests and prevents potential complications. By understanding the procedure and implementing these guidelines, you can effectively manage the closure of your Axis Bank current account, minimizing potential disruptions and ensuring a smooth transition. Remember to retain copies of all documentation for your records, serving as a valuable reference for any future needs.

Mastering metric bolt torque specs in aluminum a comprehensive guide

Duramax 66 turbo diesel issues decoded

Unlocking cozy chic with behr merino wool paint