Mastering the Cheque Issue Letter: Your Guide to Smooth Transactions

Ever found yourself needing to provide a formal record of a cheque you've issued? Maybe you're dealing with a vendor, settling a bill, or making a large purchase. A cheque issue letter can be a crucial document in these situations, providing clarity and preventing future misunderstandings. This guide delves deep into the world of cheque issue letters, exploring everything from their structure and purpose to common pitfalls and best practices.

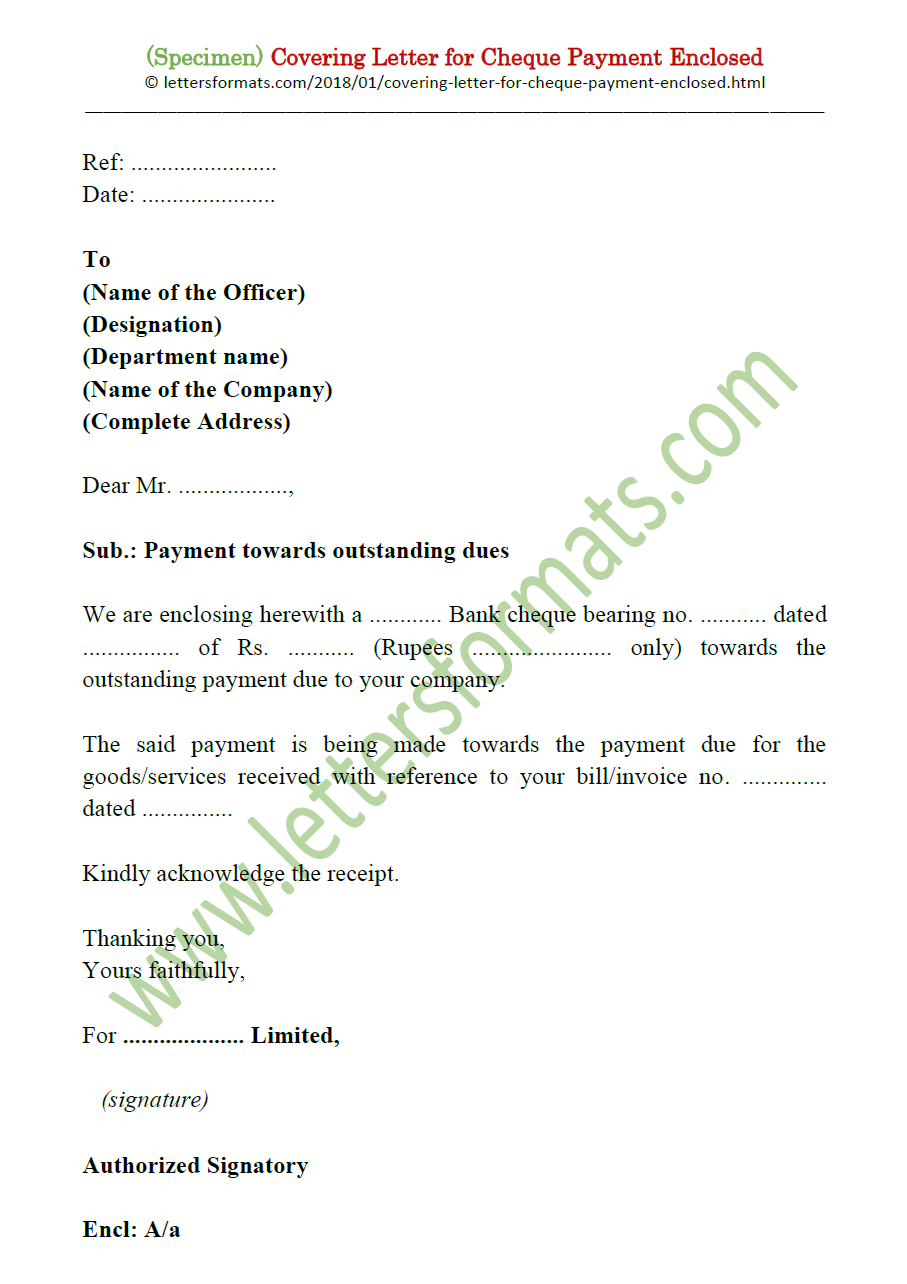

Think of a cheque issue letter as a companion to your cheque. It's a formal document confirming the details of the cheque transaction, including the cheque number, date, amount, and payee. While not always mandatory, it offers a valuable layer of transparency, especially in business dealings or when significant sums of money are involved. It's your way of saying, "Here's a documented record of this payment."

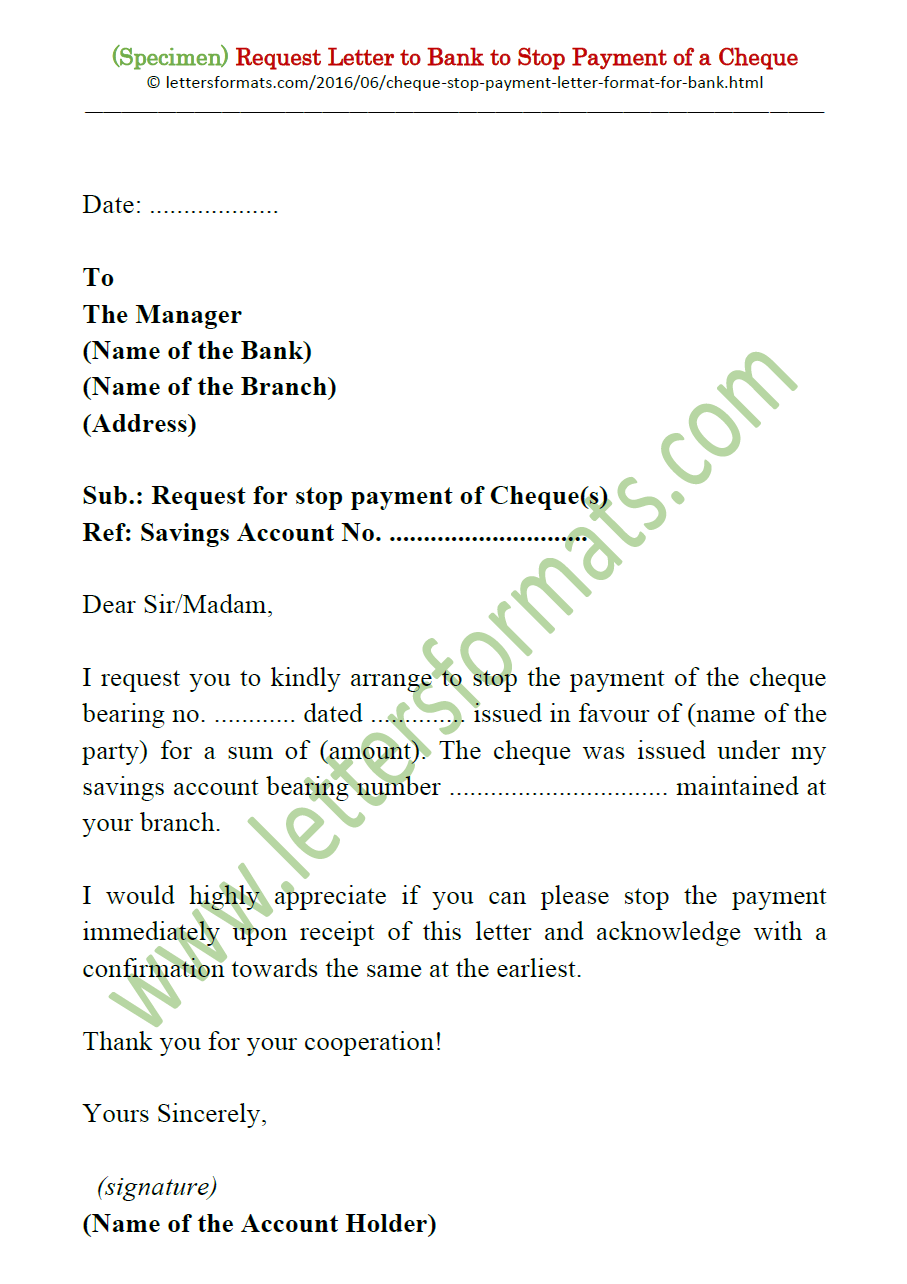

Navigating the world of financial transactions can be tricky. Misplaced cheques, forgotten payments, and disputes can arise. A cheque issue letter acts as a safety net, providing a clear record of the transaction should any questions arise later. This can be invaluable in resolving discrepancies or providing proof of payment.

Whether you're a seasoned business owner or an individual managing personal finances, understanding the nuances of cheque issue letters can empower you to handle transactions with confidence. From clarifying payment details to preventing potential disputes, this simple yet powerful document can simplify your financial life.

This guide aims to demystify the cheque issue letter, providing you with the knowledge and tools to create effective and professional letters for any situation. We'll explore different scenarios where a cheque issue letter becomes especially important and offer step-by-step guidance on crafting your own.

The history of cheque issue letters is closely tied to the history of cheques themselves. As cheques became a common payment method, the need for a formal record of their issuance grew. This led to the development of standardized letter formats, which evolved over time to include essential information like the cheque number, date, amount, payee, and purpose of payment.

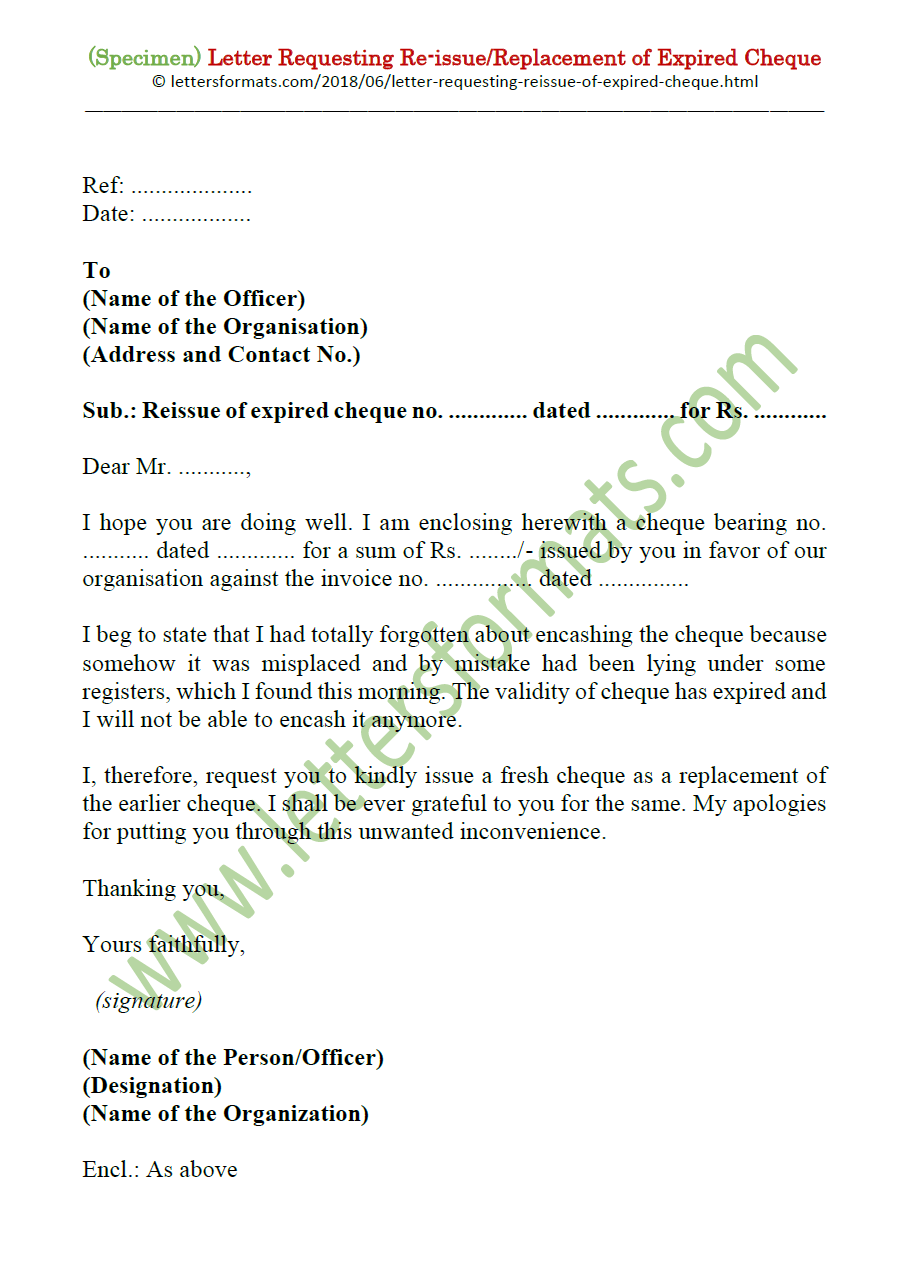

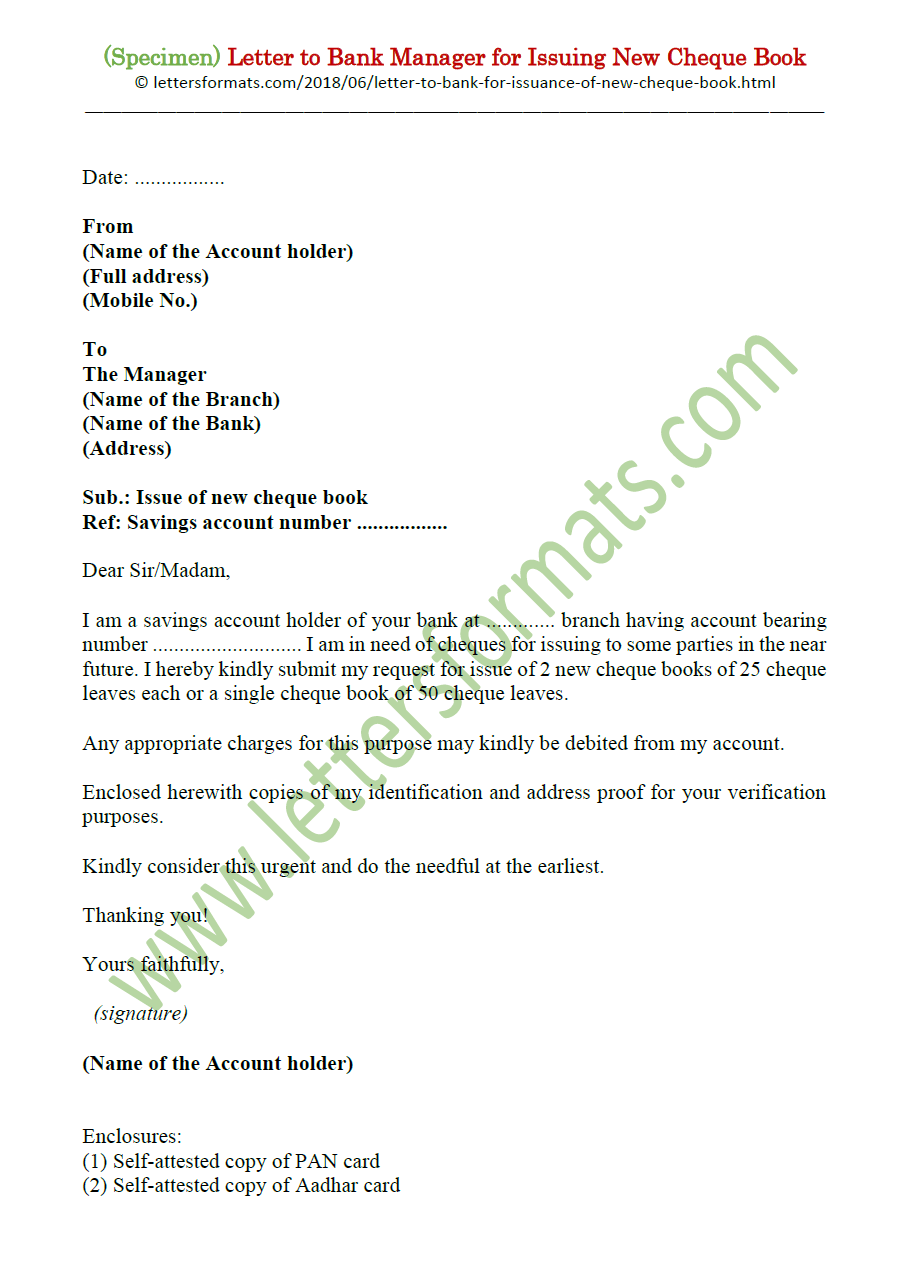

A cheque issue letter typically includes: Date, Recipient Information, Sender Information, Cheque Number, Cheque Amount, Purpose of Payment, and a Closing.

Benefits of using a cheque issue letter: Proof of Payment, Dispute Resolution, and Enhanced Professionalism. For example, if a vendor claims they haven't received payment, the cheque issue letter serves as immediate proof that the cheque was issued.

Steps to writing a cheque issue letter: Gather all relevant information (cheque number, date, amount, payee details). Use a professional tone and clear language. Clearly state the purpose of the cheque. Keep a copy of the letter for your records.

Recommendations: Consult with a financial advisor for specific guidance on handling financial documentation.

Advantages and Disadvantages of Cheque Issue Letters

| Advantages | Disadvantages |

|---|---|

| Provides proof of payment | Requires extra effort to create and send |

| Helps resolve payment disputes | Not always necessary for small transactions |

| Enhances professionalism | Can be time-consuming |

Best Practices: Always keep a copy of the letter. Use a professional letterhead (if applicable). Be concise and to the point. Double-check all information for accuracy. Send the letter promptly after issuing the cheque.

Real-world examples: Paying rent, Settling an invoice, Making a down payment on a purchase, Refunding a deposit, Donating to a charity.

Challenges: Lost letters, Incorrect information, Disputes over payment. Solutions: Send the letter via certified mail, Double-check all details before sending, Maintain clear communication with the recipient.

FAQs: What information should be included in a cheque issue letter? When should I send a cheque issue letter? Is a cheque issue letter legally required? What if the recipient loses the letter? What if the cheque is lost or stolen? How long should I keep copies of cheque issue letters? Can I email a cheque issue letter? Can I use a template for a cheque issue letter?

(General answers for these FAQs can be easily found online)

Tips & Tricks: Use a template to save time. Keep a digital copy of all your cheque issue letters. Consider using certified mail for important transactions.

In conclusion, the cheque issue letter might seem like a small detail, but it plays a significant role in ensuring smooth and transparent financial transactions. It offers a clear record of payment, helps resolve disputes, and promotes professionalism in your dealings. From understanding its historical context to mastering its format and best practices, this guide has equipped you with the knowledge to utilize cheque issue letters effectively. By incorporating these insights into your financial practices, you can navigate payments with greater confidence, minimizing the risk of misunderstandings and ensuring seamless transactions. Take the time to craft clear and accurate cheque issue letters, and you'll be well-prepared to handle any payment situation that comes your way. Remember, a little extra effort in documentation can go a long way in maintaining strong financial relationships and avoiding potential headaches down the line. Don't underestimate the power of this simple yet effective tool in managing your finances efficiently and professionally. Start implementing these best practices today and experience the peace of mind that comes with organized and well-documented transactions.

Unlocking fifa 21 ultimate team your web app guide

Resident evil 4 playable ada unveiling the agents separate ways

Decoding cape may blue benjamin moores coastal hue