Sending a Wire Transfer with Wells Fargo Made Easy

Need to send money quickly and securely? Wire transfers are a reliable option, and Wells Fargo offers several ways to initiate them. This comprehensive guide will walk you through the process, answering common questions and offering valuable insights to ensure a smooth transaction.

Transferring funds electronically has become a cornerstone of modern finance. Whether it's for international payments, large purchases, or business transactions, wire transfers provide a rapid and efficient method. Wells Fargo, a major player in the financial industry, provides its customers with various avenues for sending wire transfers.

The origins of wire transfers can be traced back to the telegraph era, evolving with technology to become the digital system we use today. With Wells Fargo, you can initiate a wire transfer through online banking, by visiting a branch, or even by phone. Understanding the nuances of each method is key to a successful transfer.

One of the main issues surrounding wire transfers is security. Protecting your financial information is paramount. Wells Fargo employs robust security measures, but it's crucial for customers to be vigilant and aware of potential scams. This guide will highlight some best practices to keep your funds safe.

Choosing the right method for initiating a Wells Fargo wire transfer depends on your individual circumstances. Online transfers offer convenience, while in-person branch visits provide personalized assistance. We’ll break down the pros and cons of each option to help you make an informed decision.

A wire transfer is an electronic transfer of funds from one bank account to another. It is often used for large or urgent transactions, where speed and security are important. For example, when buying a house, a wire transfer is often used to transfer the down payment to the seller.

Benefits of Using Wells Fargo for Wire Transfers:

1. Speed: Wire transfers are generally faster than other methods of transferring money, such as ACH transfers. Funds can often be available within the same business day, especially for domestic transfers.

2. Security: Wells Fargo employs strong security measures to protect your financial information. Two-factor authentication and encryption help safeguard your transactions.

3. Wide Reach: Wells Fargo facilitates wire transfers both domestically and internationally, allowing you to send money to a vast network of banks worldwide.

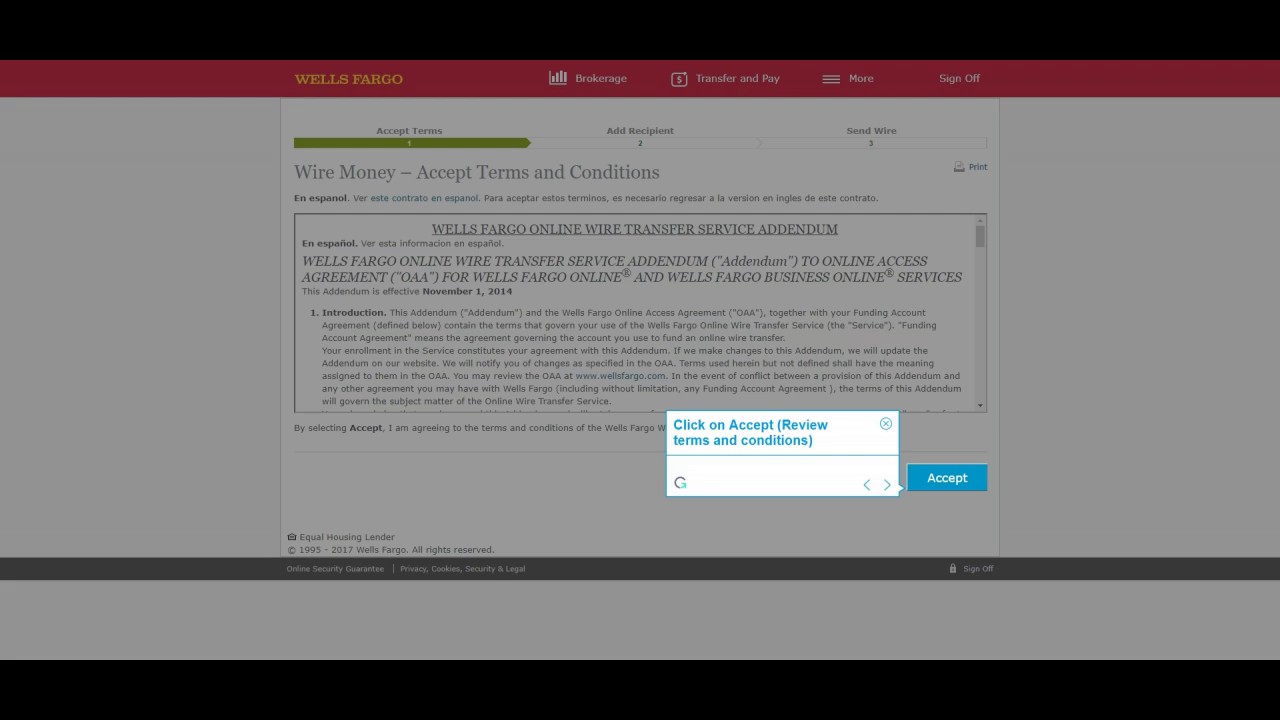

Step-by-step guide for sending a domestic wire transfer online with Wells Fargo:

1. Log in to your Wells Fargo online banking account.

2. Navigate to the "Transfer Money" or "Wire Transfer" section.

3. Select "Send a Wire Transfer".

4. Enter the recipient's bank account information, including their name, account number, and bank routing number.

5. Enter the amount you wish to transfer.

6. Review the details and confirm the transfer.

Advantages and Disadvantages of Wells Fargo Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Fast transfer speeds | Potentially higher fees than other transfer methods |

| Secure transactions | Requires accurate recipient information |

| Wide network for domestic and international transfers | Irreversible once completed |

Best Practices:

1. Double-check recipient information.

2. Be aware of fees.

3. Keep your login credentials secure.

4. Verify the recipient's identity independently.

5. Use strong passwords.

FAQs:

1. What are the fees for sending a wire transfer with Wells Fargo? (Answer: Fees vary depending on the type and destination of the transfer.)

2. How long does a wire transfer take? (Answer: Typically, domestic wire transfers can be completed within the same business day.)

3. Can I cancel a wire transfer? (Answer: It's difficult to cancel a wire transfer once it's been initiated. Contact Wells Fargo immediately if you need to attempt a cancellation.)

4. How do I track my wire transfer? (Answer: You can track your wire transfer through your Wells Fargo online banking account or by contacting customer service.)

5. What information do I need to send a wire transfer? (Answer: You'll need the recipient's name, account number, bank name, and routing number.)

6. Is it safe to send a wire transfer online? (Answer: Yes, Wells Fargo employs security measures to protect online wire transfers. However, always be cautious and follow security best practices.)

7. Can I send a wire transfer internationally through Wells Fargo? (Answer: Yes, Wells Fargo facilitates international wire transfers.)

8. What should I do if I suspect fraudulent activity related to my wire transfer? (Answer: Contact Wells Fargo immediately to report any suspicious activity.)

Tips and Tricks:

Use Wells Fargo's online resources to familiarize yourself with their wire transfer policies and procedures.

In conclusion, sending a wire transfer with Wells Fargo can be a straightforward process if you're prepared. By understanding the various options, fees, security measures, and best practices, you can confidently transfer funds electronically. Utilizing online banking offers convenience, while in-branch services provide personalized support. Remember to always double-check recipient information and be aware of potential scams. The ability to quickly and securely send money across the globe is a vital tool in today’s interconnected world. Take advantage of the resources available, including Wells Fargo’s online tools and customer service, to make your wire transfer experience as smooth as possible. Contact Wells Fargo directly for the most up-to-date information and to address any specific questions or concerns.

Unveiling benjamin moores deep secret a guide to the enigmatic paint color

Decoding the hybrid reactive bowling ball

Honda accord lug nut pattern your comprehensive guide