Unlocking Global Finance: Your Guide to Western Union Bank Transfers

Need to send money across borders quickly and reliably? Direct bank transfers via Western Union offer a convenient solution for personal and business transactions. This guide will delve into the intricacies of utilizing Western Union to transfer funds directly to bank accounts, offering a comprehensive overview of the process, its advantages, potential pitfalls, and best practices.

Sending money internationally can often seem complex, fraught with hidden fees and lengthy processing times. Western Union provides a well-established platform for moving funds globally, and the option to deposit directly into a recipient's bank account adds a layer of convenience and security. Understanding the nuances of this method can empower you to make informed decisions and navigate the process with ease.

Western Union's history traces back to 1851, starting as a telegraph company. Over time, they evolved into a leading global money transfer service. The ability to send Western Union transfers directly to bank accounts has become increasingly crucial in our interconnected world, facilitating everything from family support to international business transactions. This method offers a more streamlined approach compared to traditional cash pickups, providing direct access to funds for recipients.

One of the primary concerns when sending money internationally is security. Western Union employs various security measures to protect your transactions. However, it's essential to be aware of potential scams and fraudulent activities. Being informed about common scams related to money transfers can help you avoid becoming a victim. Always verify the recipient's identity and be wary of unusual requests.

Choosing the right money transfer method is crucial for both senders and recipients. Factors to consider include transfer speed, fees, exchange rates, and accessibility. Western Union bank transfers offer a balance between speed and cost-effectiveness, making them a suitable choice for various needs. The convenience of direct bank deposits eliminates the need for recipients to visit a physical location for pickup.

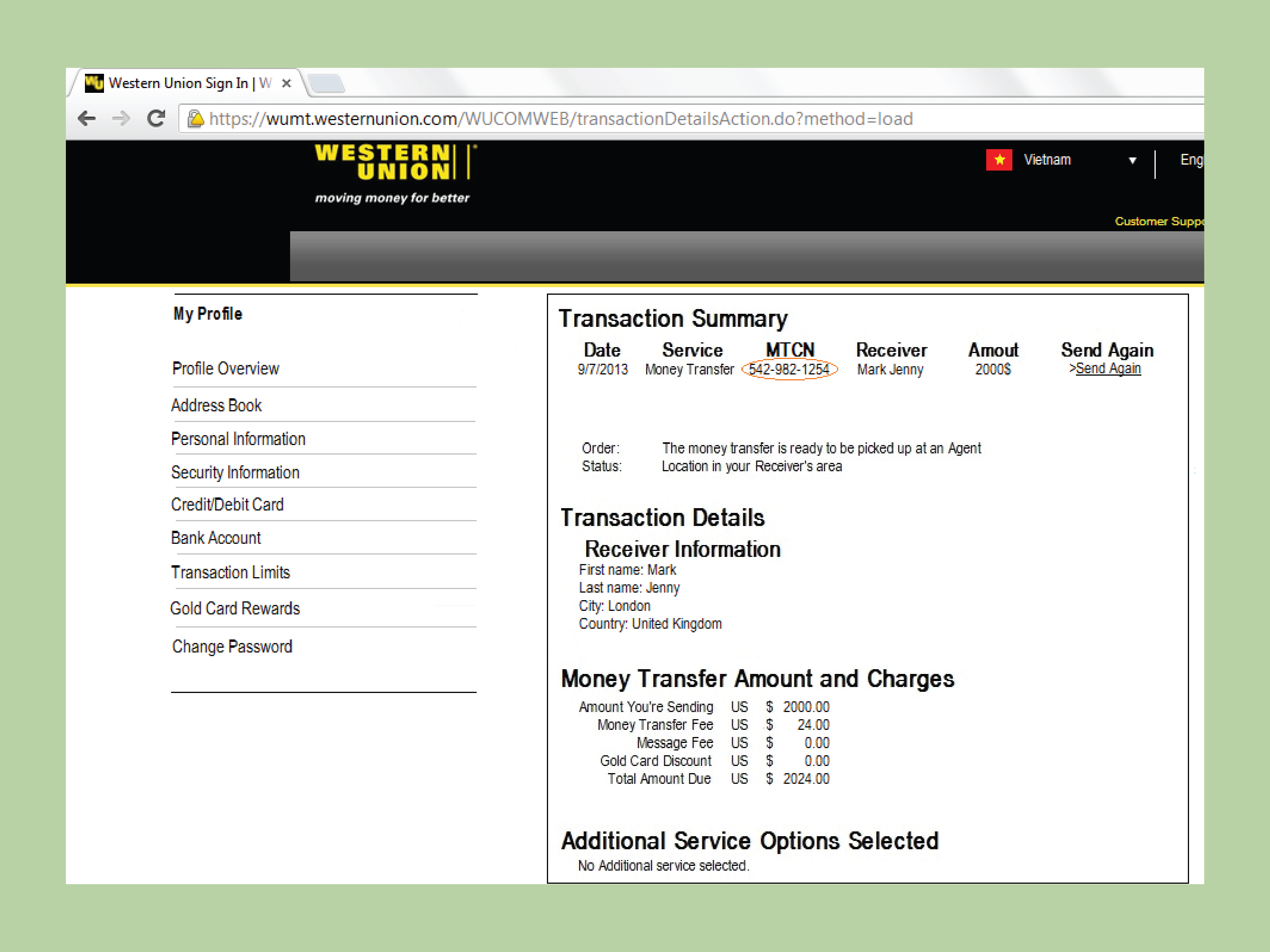

A Western Union bank account transfer involves sending money directly to a recipient's bank account instead of a cash pickup location. This typically requires the recipient's bank account details, including their name, bank name, account number, and possibly SWIFT code or IBAN, depending on the country. You can initiate transfers online, through the Western Union app, or at an agent location.

Benefits of sending money via Western Union to a bank account include speed, convenience, and security. Transfers are often completed quickly, eliminating the need for recipients to travel to a physical location. The direct deposit adds security by reducing the risk of lost or stolen cash. Furthermore, the wide network of Western Union makes it accessible in numerous countries.

To send money via Western Union to a bank account, you will need the recipient's bank account information, including their full name, bank name, account number, and potentially SWIFT/IBAN. You can initiate the transfer online, through the mobile app, or at an agent location. After providing the necessary information and paying the transfer fee, the funds are typically sent within a short timeframe.

Advantages and Disadvantages of Western Union Bank Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and Convenience | Potential Fees |

| Wide Global Reach | Exchange Rate Fluctuations |

| Direct Bank Deposit | Security Risks (if not careful) |

Frequently Asked Questions:

1. How long does a Western Union bank transfer take? Typically, transfers are completed within a few business days.

2. What fees are associated with Western Union bank transfers? Fees vary depending on the amount sent, destination country, and payment method.

3. How can I track my Western Union transfer? You can track your transfer online using the tracking number provided.

4. Is it safe to send money via Western Union to a bank account? Yes, provided you verify the recipient's identity and use official Western Union channels.

5. What information do I need to send money to a bank account? You'll need the recipient's bank name, account number, SWIFT/IBAN, and full name.

6. Can I cancel a Western Union bank transfer? Contact Western Union customer service as soon as possible. Cancellation may be possible depending on the transfer status.

7. What should I do if I suspect fraud? Report any suspicious activity to Western Union immediately.

8. Are there limits on how much I can send? Yes, limits may apply depending on your location and the recipient's country.

Tips for using Western Union: Double-check all recipient information. Compare fees and exchange rates. Keep your tracking number safe. Be wary of unsolicited requests for money transfers.

In conclusion, sending money via Western Union directly to a bank account offers a convenient, relatively fast, and secure method for international transfers. By understanding the process, fees, and security measures, you can effectively utilize this service for personal or business needs. While it offers numerous advantages like speed and convenience, being aware of potential fees and exchange rate fluctuations allows for informed decision-making. By following best practices and verifying recipient information, you can mitigate security risks and ensure a smooth transfer experience. Utilizing Western Union's online platform or mobile app enhances the ease and accessibility of managing your international money transfers, providing a valuable tool for navigating the complexities of global finance. This method offers a reliable solution for supporting loved ones abroad, conducting business transactions, or addressing various financial needs across borders. Take advantage of the convenience and reach offered by Western Union bank transfers to manage your international financial needs efficiently.

Ignite a love of reading with fancy nancy books

Mastering car wheel measurement a comprehensive guide

Unleashing the beast chevy 2500 towing capacity