Unlocking Your 403(b): Navigating Taxes & Early Withdrawals

Are you dreaming of a sun-drenched escape or a kitchen renovation, and eyeing your 403(b) as a potential source of funds? Before you dip into those retirement savings, it's essential to understand the potential tax implications. Withdrawing from your 403(b) before retirement can be a complex undertaking, with potential penalties and taxes that could significantly impact your financial well-being.

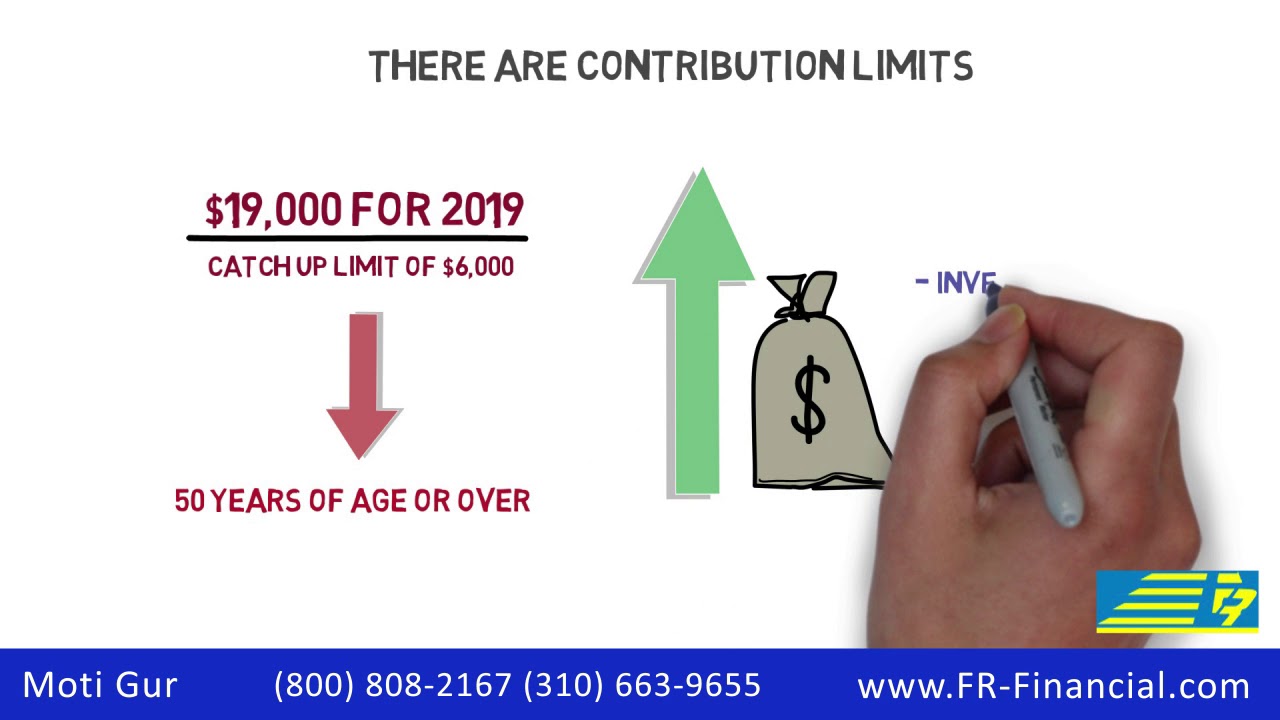

Navigating the landscape of 403(b) withdrawals requires a deep understanding of the rules and regulations. These tax-advantaged retirement plans, often offered to employees of public schools and certain non-profit organizations, allow pre-tax contributions to grow tax-deferred. However, accessing these funds before age 59 1/2 often triggers a 10% additional tax penalty on top of your regular income tax rate.

The history of 403(b) plans and their associated tax regulations is intertwined with the broader evolution of retirement savings in the United States. These plans were designed to incentivize long-term saving for retirement, and the tax penalties for early withdrawals are intended to discourage individuals from prematurely accessing these funds. Understanding the underlying principles behind these rules can empower you to make informed decisions about your financial future.

One of the central issues surrounding 403(b) taxation is the potential impact on your overall financial plan. Early withdrawals can erode your retirement nest egg, potentially delaying your retirement goals. Careful planning and consideration of alternative funding sources are essential before tapping into your 403(b).

Let's delve into the specifics of 403(b) withdrawals and the associated tax consequences. When you withdraw funds, the amount is considered ordinary income and is taxed at your current income tax bracket. This means that the more you withdraw, the higher your taxable income for the year, potentially pushing you into a higher tax bracket. Adding to this, if you are under 59 1/2, that 10% penalty can significantly reduce the amount you actually receive.

While generally it’s advisable to avoid early 403(b) withdrawals, there are some exceptions to the 10% penalty, such as for certain hardships, total and permanent disability, and other qualifying events. Consult a qualified financial advisor to determine if you qualify for an exemption.

Advantages and Disadvantages of Early 403(b) Withdrawals

| Advantages | Disadvantages |

|---|---|

| Access to funds for emergencies or specific needs | 10% early withdrawal penalty (generally) |

| Potential to address immediate financial challenges | Reduction of retirement savings |

| Flexibility in certain hardship situations | Tax liability on withdrawn amount |

Frequently Asked Questions About 403(b) Withdrawals and Taxes

1. What is the penalty for withdrawing from my 403(b) before age 59 1/2? Generally, a 10% additional tax penalty.

2. How are 403(b) withdrawals taxed? As ordinary income at your current tax bracket.

3. Are there any exceptions to the early withdrawal penalty? Yes, for certain hardships and other qualifying life events.

4. How can I minimize the tax impact of a 403(b) withdrawal? Consult a financial advisor for personalized strategies.

5. What are the long-term implications of early withdrawals? Potential reduction of retirement savings and delayed retirement.

6. Where can I find more information on 403(b) tax rules? Consult the IRS website or a qualified financial advisor.

7. Should I consider a loan from my 403(b) instead of a withdrawal? Discuss the pros and cons with a financial advisor.

8. How can I calculate the taxes I will owe on a 403(b) withdrawal? Use a tax calculator or consult with a tax professional.

Tips for Managing 403(b) Withdrawals:

Explore alternative funding sources before tapping your 403(b). Carefully consider the long-term impact on your retirement goals. Consult with a financial advisor to understand the tax implications and available options.

Understanding the tax ramifications of withdrawing from your 403(b) is a crucial element of financial wellness. By carefully considering the potential penalties, taxes, and long-term impact on your retirement savings, you can make empowered decisions that align with your overall financial goals. While accessing these funds can provide a temporary solution to immediate financial needs, it’s essential to weigh the benefits against the potential drawbacks. Consulting with a qualified financial advisor can provide personalized guidance and support, ensuring you make choices that best serve your individual circumstances. Remember, your future self will thank you for the thoughtful consideration you give to your retirement savings today. This journey towards financial security requires careful planning and informed decision-making. Empower yourself with knowledge, seek expert advice, and prioritize your long-term financial well-being.

Engaging activities for 9th graders academic success

Captivated by curry manga a deep dive

Behr distant star paint a cosmic choice for your walls

+Reduce+future+income+taxation+with+after-tax.jpg)