Wells Fargo Wire Transfers: Understanding Routing Numbers

Moving money quickly and securely is essential in today's world. Wire transfers offer a reliable way to do this, and understanding the role of routing numbers is key. This article focuses on Wells Fargo routing numbers for wire transfers, providing a clear and simple guide.

Imagine needing to send funds urgently to another account. A wire transfer provides that speed, but requires specific information, including the correct routing number. For Wells Fargo customers, knowing the right routing number is the first step towards a successful transaction. We'll explore how to find this information and why it's so important.

Think of the routing number as an address for your bank. Just like a postal address directs mail, the routing number directs the wire transfer to the correct financial institution. Using the wrong number can lead to delays, or worse, the funds being sent to the wrong account. This guide will clarify how to avoid such issues.

A Wells Fargo routing number for domestic wire transfer differs from the one used for international transfers or even paper checks. Understanding these distinctions prevents errors and ensures your money reaches its intended destination. We'll break down the various Wells Fargo routing numbers and their specific uses.

This article serves as your comprehensive guide to Wells Fargo wire transfer routing numbers. We will delve into the details, offering practical advice and clear explanations to simplify this often confusing process. By the end, you'll have the knowledge to confidently initiate and receive wire transfers.

The routing number system in the United States originated to facilitate the efficient processing of checks and electronic transfers between banks. Originally, each bank was assigned a unique number, allowing for automated sorting and processing. Over time, this system evolved to accommodate the increasing complexity of financial transactions, including wire transfers. For Wells Fargo, its routing numbers reflect its history and geographic reach, varying depending on the state where the account was opened.

The primary issue related to Wells Fargo wire transfer routing numbers is using the incorrect one. This can cause delays, rejected transfers, or even misdirected funds. Another potential issue is security. Sharing your routing number with unauthorized individuals can expose your account to fraud. This guide emphasizes the importance of safeguarding this sensitive information.

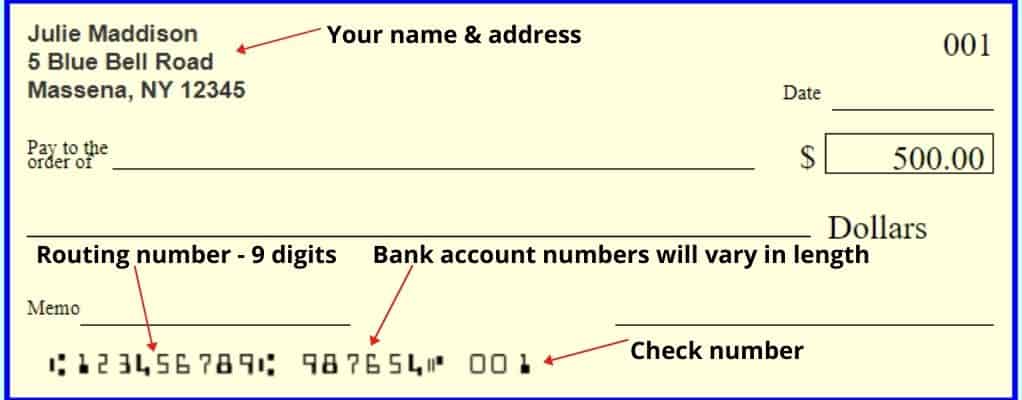

The routing number is a nine-digit code that identifies the financial institution involved in a transaction. For a Wells Fargo wire transfer, the correct routing number ensures that the funds are deposited into the correct account. For example, a domestic wire transfer within California may use a different routing number than a transfer originating in New York to a different state.

Benefits of using the correct Wells Fargo routing number for wire transfers include: Speed: Accurate information ensures prompt processing. Security: Using the right number minimizes the risk of misdirected funds. Efficiency: Avoids delays and potential return of the transfer due to incorrect information.

To find your correct Wells Fargo routing number for wire transfer, log into your online banking account, check your printed checks, or contact Wells Fargo customer service. Always double-check the number for accuracy before initiating a transfer.

Before initiating a Wells Fargo wire transfer, confirm the recipient's details, the correct routing number, and the amount. Double-check all information to avoid errors.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible |

| Reliability | Potential for Delays with Incorrect Information |

Best Practices for Wells Fargo Wire Transfers

1. Verify recipient information.

2. Double-check the routing number.

3. Use secure online banking.

4. Keep records of your transactions.

5. Contact Wells Fargo for any discrepancies.

Frequently Asked Questions about Wells Fargo Wire Transfer Routing Numbers

1. What is a routing number? - A nine-digit code identifying a financial institution.

2. Where can I find my Wells Fargo routing number? - Online banking, checks, customer service.

3. Is the routing number the same for all Wells Fargo accounts? - No, it varies by state and type of transaction.

4. What happens if I use the wrong routing number? - Delays, rejection, or misdirected funds.

5. How can I ensure my wire transfer is secure? - Verify information, use secure channels, and keep records.

6. Can I cancel a wire transfer? - Contact Wells Fargo immediately; it may be possible if the transfer hasn't been processed.

7. What are the fees associated with wire transfers? - Contact Wells Fargo for current fee information.

8. What is the difference between a domestic and international wire transfer? - Different routing numbers and processes apply.

Tips and Tricks

Always verify information with Wells Fargo directly. Save copies of your transfer confirmations. Set up transaction alerts for added security.

In conclusion, understanding the importance of Wells Fargo routing numbers for wire transfers is crucial for successful and secure transactions. By using the correct routing number, you ensure your funds reach their intended destination quickly and efficiently. This guide provides the necessary information to navigate the process with confidence. Remember to always double-check information, use secure channels, and contact Wells Fargo for any questions or concerns. Taking these precautions will simplify your wire transfer experience and provide peace of mind knowing your funds are handled securely. Being proactive and informed empowers you to manage your finances effectively. Don't hesitate to reach out to Wells Fargo for further assistance or clarification on any aspect of wire transfers.

Unlocking the gs 12 pay scale your guide to federal salaries

Decoding the medicare provider enrollment fee labyrinth

Lake forest pointe at st lucie florida living decoded