Western Union Online Money Transfers: A Deep Dive

In today's interconnected world, the need to send money across borders has become increasingly common. Whether it's supporting family abroad, paying for international services, or managing investments overseas, the ability to transfer funds quickly and securely is paramount. Western Union's online money transfer service has emerged as a prominent player in this space, offering a digital platform for sending money virtually anywhere.

The digital realm has revolutionized how we interact with financial services, and money transfers are no exception. Western Union, a longstanding name in the remittance industry, has adapted to this shift by offering a robust online platform. This allows users to bypass physical agent locations and initiate transfers from the convenience of their computers or mobile devices. This shift toward digital money transfers has significantly impacted how people manage their finances globally.

Sending money through Western Union online provides a compelling alternative to traditional methods. The convenience of initiating transfers anytime, anywhere, combined with the speed of digital transactions, makes it an attractive option for many. However, understanding the nuances of the service, including fees, exchange rates, and security measures, is essential for making informed decisions.

The history of Western Union is deeply intertwined with the evolution of communication technology. Founded in 1851 as the New York and Mississippi Valley Printing Telegraph Company, the company quickly recognized the potential for transferring money alongside messages. This early innovation laid the groundwork for the global money transfer giant we know today. Western Union's online platform represents the latest iteration of this long history of innovation, leveraging technology to connect people and their finances across borders.

The ability to conduct Western Union money transfers online has become increasingly important in a globalized world. It facilitates cross-border commerce, supports migrant workers sending remittances home, and enables individuals to assist family and friends in times of need. However, the landscape of online money transfers is complex, with issues such as security concerns, varying fees, and fluctuating exchange rates requiring careful consideration.

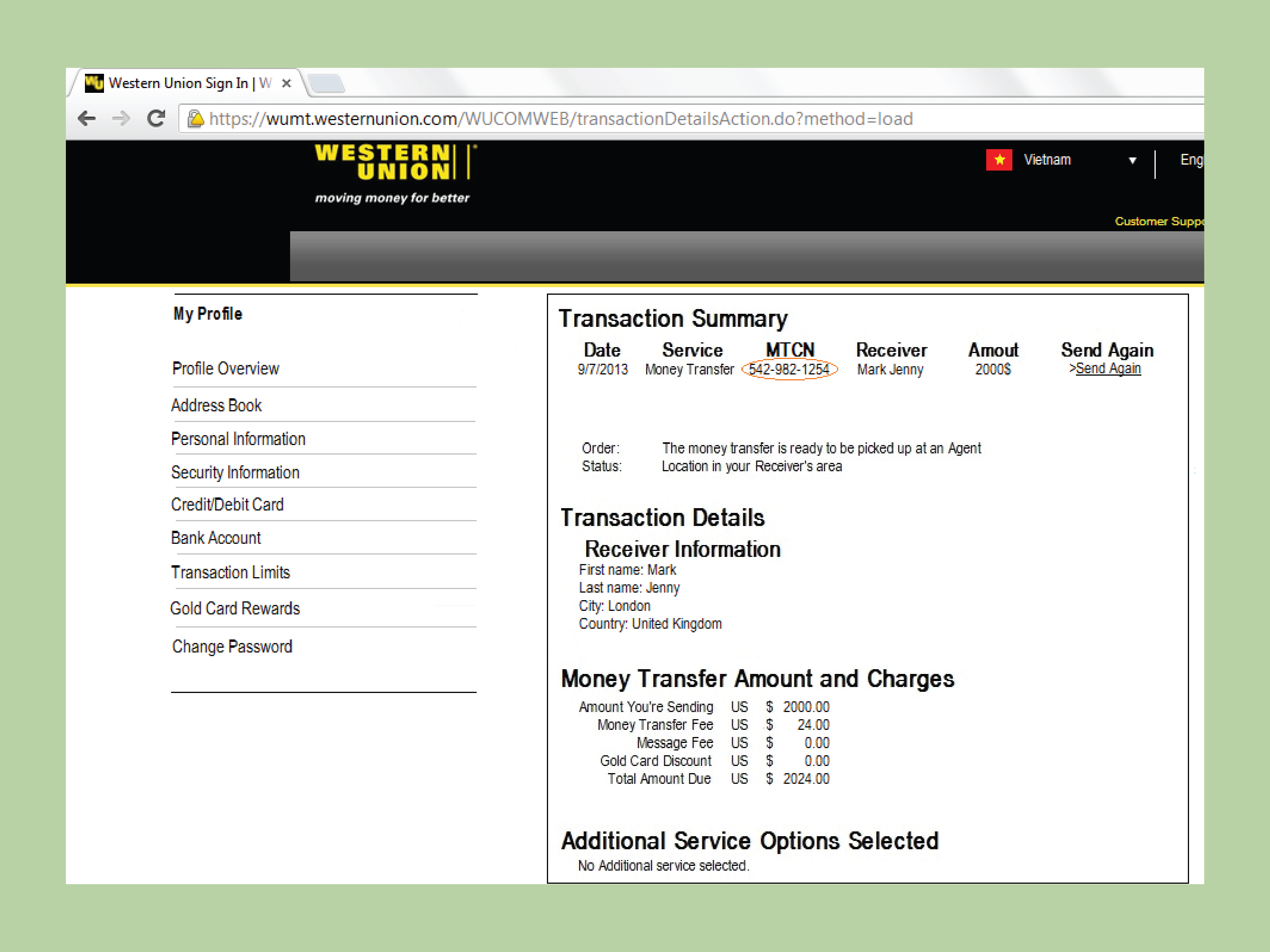

Using Western Union to send money online typically involves creating an online profile, providing recipient details, selecting a payment method, and confirming the transfer. The recipient can then collect the funds at a designated agent location or have them deposited directly into their bank account, depending on the receiving country's options.

Benefits of using Western Union online include speed, convenience, and global reach. Transfers can often be completed within minutes, eliminating the need for physical visits to agent locations. The global network of Western Union agents provides extensive coverage, allowing for money transfers to numerous countries worldwide. For example, a user in the United States can easily send money to a family member in the Philippines through the online platform.

Advantages and Disadvantages of Western Union Online Money Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and Convenience | Fees and Exchange Rates |

| Global Reach | Security Concerns |

| Multiple Payment and Receiving Options | Customer Service Issues |

Best Practices:

1. Verify recipient details carefully.

2. Compare fees and exchange rates.

3. Protect your login credentials.

4. Be aware of scams.

5. Keep transaction records.

FAQs:

1. How do I send money online with Western Union? (Answer: Create an account, provide recipient details, choose payment method, confirm transfer.)

2. What are the fees? (Answer: Fees vary depending on the amount sent, destination country, and payment method.)

3. How long does a transfer take? (Answer: Transfers can be completed within minutes or may take a few days.)

4. How does the recipient receive the money? (Answer: Cash pickup at an agent location or direct deposit to a bank account.)

5. Is it safe to send money online with Western Union? (Answer: Western Union employs security measures to protect transactions.)

6. What if I need to cancel a transfer? (Answer: Contact customer support as soon as possible.)

7. What are the exchange rates? (Answer: Exchange rates fluctuate and can be viewed on the Western Union website.)

8. How do I track my transfer? (Answer: Use the tracking tool on the website or mobile app.)

Tips and Tricks:

Sign up for email alerts to track exchange rate fluctuations. Compare fees and exchange rates before sending money.

In conclusion, Western Union's online money transfer service offers a powerful tool for sending money across borders. Its speed, convenience, and global reach provide significant advantages in today's interconnected world. However, understanding the associated fees, exchange rates, and security measures is crucial for making informed decisions. By following best practices and staying informed, users can leverage the benefits of Western Union online money transfers effectively, connecting with loved ones and managing their finances globally. As the digital landscape continues to evolve, Western Union online money transfers are likely to play an increasingly vital role in facilitating seamless cross-border transactions. Explore the options, compare services, and choose the best method for your individual needs to send money with confidence and ease.

Liga mx electrifies fc 24 a deep dive

Mastering classic paladin skills progression

Unlocking skip bo a deep dive into card game rules and strategy